japan corporate tax rate 2022

United States Corporate Tax Rate was 21 in 2022. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019.

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Income Tax Rates and Thresholds Annual Tax Rate.

. There are seven tax rates in 2022. Additionally a local enterprise tax is also levied by the prefecture on corporations. In 2000 the average corporate tax rate was 326 percent and has decreased consistently to its current level of 213 percent.

Corporate and international tax proposals in tax reform package 19 December 2018 The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and international tax measures. Manchin has said he backs hiking the corporate tax rate to 25 as part of a future spending bill. Corporate Tax Rate in Japan is expected to reach 3062 percent by the end of 2021 according to Trading Economics global macro models and analysts expectations.

He told NBC News earlier this month that hes onboard with a 15 corporate minimum tax a 28. KPMGs corporate tax rates table provides a view of corporate tax rates around the world. An already legislated corporate rate reduction is expected to progressively bring down the corporate tax rate to 2583 percent by 2022.

The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy on corporate inhabitant tax for each taxable year are shown below. In this alert we provide an overview of the major reforms and revised provisions contained in the outline. 152 rows Domestic Companies a 25 if turnovergross receipts do not exceed INR 4 billion for FY 2019-2020 surcharge ranging from 7 to 12 of tax applicable depending upon the total income.

For example the 2021 taxes are paid in four installments in June August and October 2022 and January 2023. United Arab Emirates 1605 GDP YoY Forecast. 10 12 22 24 32 35 and 37.

Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. Please note that provisions may be revised deleted or added during Diet deliberations regarding the reform bill.

This page provides - Japan Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. EY JapanThe fiscal year 2022 tax reform outline was released on 10 December 2021. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region.

Fifteen countries do not have a general corporate income tax. Corporate Income Tax Rebates. C 30 surcharge ranging from 7 to 12 of tax.

Corporate Income Tax Rate. A standard corporate income tax rate is 232 applies to the companies that operate in Japan with a share capital over JPY 100 million. 2022 Tax Bracket and Tax Rates.

7 rows Japan Income Tax Tables in 2022. This applies to both local and foreign companies. 2022 Corporate Tax Rates in Europe Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022.

B Lower tax rate of 2215 is also applicable to corporate entities subject to certain conditions surcharge 10 of tax applicable. Data is also available for. Personal Income Tax Rate in Japan is expected to reach 5597 percent by the end of 2021 according to Trading Economics.

The tax rate is determined based on the taxable income. Heres how they apply by filing status. The rates for local taxes may vary somewhat depending on the scale of the business and the local government under whose jurisdiction it is.

Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Corporate Income Tax rebates are given to companies to ease their business costs and to. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

Local management is not required. Japan Personal Income Tax Rate - values historical data and charts - was last updated on March of 2022. If prefectural and municipal income taxes are not withheld by the employer they are to be paid in quarterly installments during the following year.

Your company is taxed at a flat rate of 17 of its chargeable income. In the long-term the Japan Corporate Tax Rate is projected to trend around 3062 percent in 2022 according to our econometric models. Puerto Rico follows at 375 and Suriname at 36.

Local inhabitants tax is levied by both prefectures and municipalities that is payable by the companies. It depends on companys scale location amount of taxable income rates of tax and the other. 167 rows Comoros has the highest corporate tax rate globally of 50.

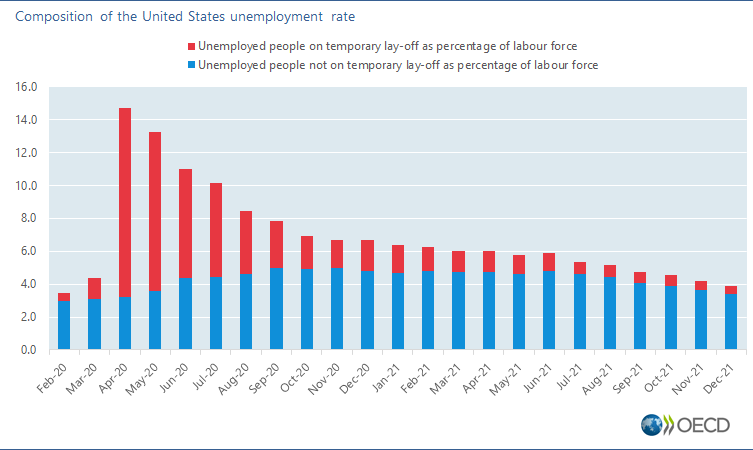

Unemployment Rates Oecd Updated January 2022 Oecd

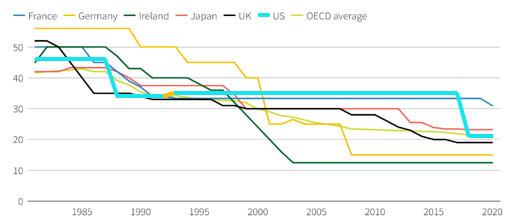

Corporate Tax Reform In The Wake Of The Pandemic Itep

United Arab Emirates Corporate Tax Rate 2021 Data 2022 Forecast

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Corporate Tax Reform In The Wake Of The Pandemic Itep

Doing Business In The United States Federal Tax Issues Pwc

Corporation Tax Europe 2021 Statista

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Tonga Sales Tax Rate 2021 Data 2022 Forecast 2014 2020 Historical Chart News

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

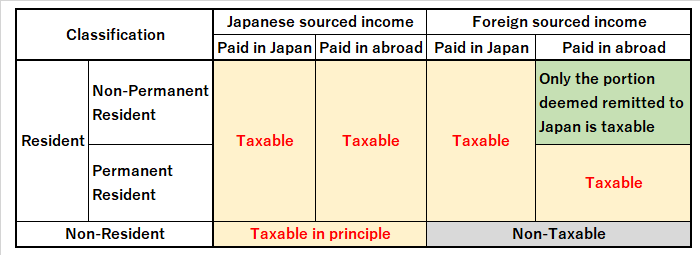

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

Corporate Income Tax Cit Rates

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates